Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large balance of marketable securities?

Did you know that Microsoft owns over $120 billion in short-term investments: over 70% of its current assets, and over 39% of its total assets? That is a large amount of money tied up in an instrument that many investors are not familiar with.

Insurance companies, banks, and other financial companies make a fair amount of their income from marketable securities in the form of net investment income. Those monies they invest in different securities such as bonds, stocks, and real estate yield decent returns for the companies, especially on a short-term basis.

Other companies such as Microsoft, Apple, and Amazon use these instruments to make money on the cash they have sitting around waiting for additional opportunities to deploy.

In today’s post, we will learn:

Okay, let’s dive in and learn more about available for sale securities.

An available for sale security, per Investopedia:

“An available-for-sale security (AFS) is a debt or equity security purchased with the intent of selling before it reaches maturity or holding it for a long period should it not have a maturity date.”

Our friends in the accounting world require that companies classify any investments or marketable securities companies make in either debt or equity securities as:

An available for sale security lists on the financial documents at fair value. Meaning that we value the security at the value of its assets and liabilities, or its estimated value as opposed to market value, which lists the value based on the markets value. This can be higher or lower than fair value.

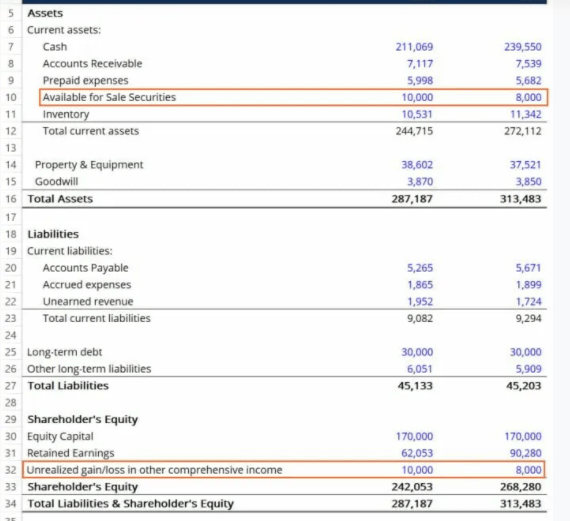

In the case of available for sale securities, these list on the balance sheet at fair value and any changes in value between any accounting periods in the accumulated other comprehensive income section. Which resides in the equity section of the balance sheet.

Discovering which investments the company holds in investment securities is as simple as looking in the 13F filing of the company. Not all companies must file these filings; it has to manage assets over $100 million for that requirement to become a reality.

For example, Microsoft does not reach that threshold, where Prudential does. We can see if we take a quick look at Prudential’s 13F filing that they hold companies as diverse as:

Okay, let’s move on and discover how the available for sale security works.

Remember that available for sale securities is an accounting term that we use to classify different financial assets.

They are a debt or equity security not in the camp of held-for-maturity or held-for-trading securities; more on these differences in the next section.

One trait concerning available for sale securities is they are nonstrategic, with a price available for sale ready at any time. All of which means the AFS is a device to earn profit for the company without a stated period instead of other securities.

Unlike gains from the other securities, unrealized gains and losses do not show up on its income statement. Rather, they show up on the company’s balance sheet in the other comprehensive income classification until the securities sell.

Net income shows up in the income statement, and any income from the sale of securities or interest income is a specific line item on the income statement. The interest income stems from interest, dividends, or other income from the investments.

All of this means that the unrealized gains or losses don’t show up on Microsoft or Prudential’s income statement.

Net income accumulates over several accounting periods into retained earnings on the balance sheet. On the other hand, OCI, which includes unrealized gains or losses from AFS securities, rolls into the AOCI (accumulated other comprehensive income) on the balance sheet at the end of the period.

You can find the accumulated other comprehensive income reported right below the retained earnings in the balance sheet’s equity section.

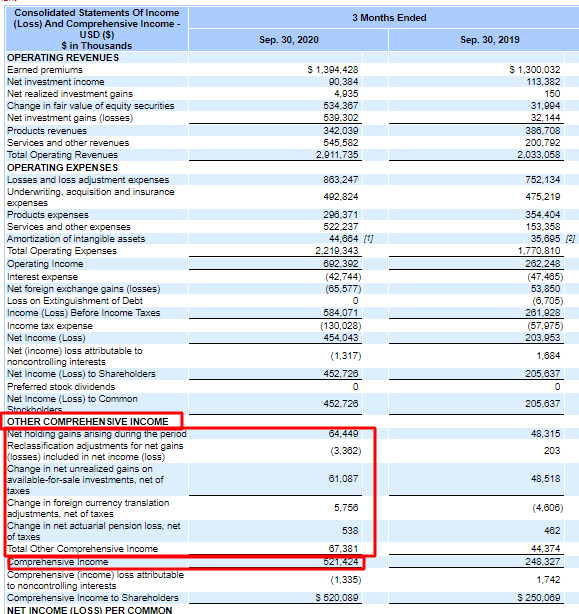

To help illustrate this flow, let’s take a look at the insurance company Markel’s (MKL) financial statements.

Below we have the other comprehensive account right below the income statement. We can see any unrealized gains or losses from the available for sale securities on the company’s balance sheets.

Here we can see that Markel earned $67,381 million in other comprehensive income, stemming largely from the change in unrealized gains from the AFS securities.

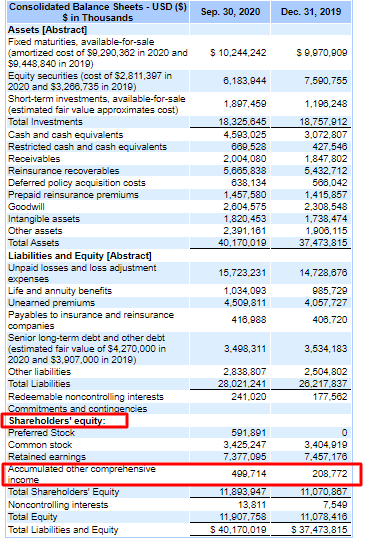

Next, we will look at the balance sheet, where we can see the total amount of available for sale securities, which totals $10,224,242 million, a ton! And in the equity section, we can see the amount of the accumulated other comprehensive income in the shareholder’s equity section, which totals $499,714 million.

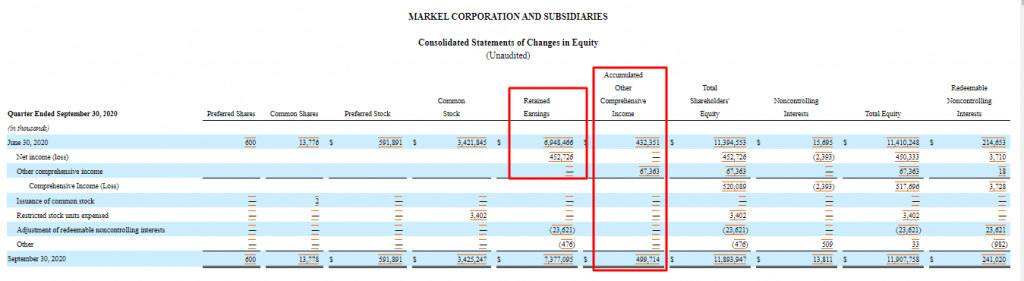

And finally, we take a look at the consolidated statement of changes in equity. Here we can see that the addition of the net income to Markel’s retained earnings and the other comprehensive income added to the other comprehensive income.

The bottom line: all the financial documents flow from one to another, and even though the sale of these securities is not happening every quarter. The unrealized gains or losses do impact the company’s value by increasing shareholder equity.

When analyzing the balance sheet of any company that carries any balance of marketable securities is looking at not only the net investment income, which is direct income from dividends, interest, and others flowing directly to the income statement.

But there is also a gain from the unrealized gains or losses to the balance sheet, which grows the shareholders’ value. Even though that growth doesn’t always correlate right to the share price, it is a value.

Let’s move on to discuss the differences between the three types of marketable securities.

As we mentioned earlier, there are three kinds of marketable securities:

Held-for-Maturity

These marketable securities are debt or equities that the company intends to hold until the maturity date. A great example is a CD (certificate of deposit) with a maturity date, such as a three-year CD. Other examples are treasury or corporate bonds with specific maturity dates, such as a 10-year.

Held-for-Trading

These marketable securities have one purpose, to be bought and sold quickly. Their purpose is to make a profit from the quick turnaround.

The securities used for held-for-trading can be either debt or equity to return a profit in the short-term.

Available-for-Sale

AFS is the catch-all category for marketable securities, with all the marketable securities falling into this category. These securities, both debt and equity, are those which the company plans to hold (generally), but with the ability to sell.

From an accounting perspective, the treatment of marketable securities is different. And the differences affect whether the gains or losses show up on the income statement or balance sheet.

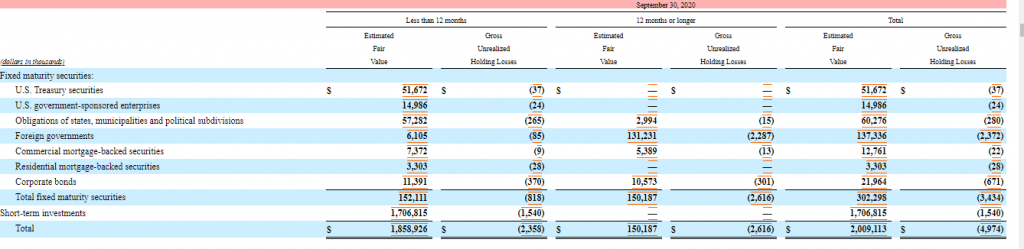

The accounting for available for sale securities is similar to trading securities. Because of the short-term nature of the investments, both types are recorded at fair value.

But trading securities, the unrealized gains or losses from the fair value of these securities, are recorded in operating income and list on the income statement. A great example of this is the portfolios held by Berkshire Hathaway and Markel.

As mentioned earlier, changes in the fair value of available for sale securities as unrealized gains or losses in the other comprehensive income statement.

Some companies list this section right below their income statement, where others choose to create a separate statement below the income statement.

Both of which feed the AOCI section of the equity section in the balance sheet.

From an accounting viewpoint, when Markel purchases available for sale of securities with $100k of cash, Markel records a credit to the cash account, with a $100k debit to the available sale securities account.

If the value of the available for sale securities slides to $60k by the next quarter, Markel must “write down” the securities to mark the securities’ fair market value change.

The decrease in value is a credit on the available for sale security account and a debit to the other comprehensive account in the balance sheet’s equity section.

All of which flows to show a decrease in the AOCI section from the decrease in the OCI statement.

Of course, if the fair value of the available for sale securities increases, then the opposite happens. They are notating an increase in the OCI, which translates to an increase in the AOCI section of the shareholders’ equity.

The realization of the benefit to the company purchasing available for sale securities is not always when the security is bought or sold.

The above is one of the advantages of owning a large bucket of available for sale securities. These investments allow many companies to invest in other securities without engaging in many activities managing the securities.

Therefore the reference to unrealized gains or losses.

Reading any company’s financial statements is a must, and understanding all of the information is sometimes confusing.

And for me, when I started down the path of learning financial companies, trying to decipher the balance sheets, in particular, is difficult.

With most insurance companies’ assets, they were particularly tied up in investments; it made sense for me to figure those out.

Marketable securities drive much of the income and value of these companies. Insurance companies make much of their income from premiums, but depending on the type of company, life, or property/casualty, another third or more of its earnings will be derived from the investment portfolio.

Most investors think that we only earn value from buying or selling investments. Still, we can earn value from the unrealized gain or losses from marketable securities in the corporate world.

Warren Buffett earns much of Berkshire’s value from the equity portfolio, which flows to the balance sheet’s shareholders’ equity section because he is not turning over much of his portfolio.

Because of recent accounting changes, much of these investments help drive value for shareholders. And companies such as Markel and Berkshire drive a lot of their value from the equity portfolios. Still, they also drive value from the available for sale securities on the balance sheet.

Learning some of the accounting related to these terms associated with the marketable securities will help you read the balance sheets of insurance companies, banks, and other financials.

But it also relates to companies such as Google, Microsoft, and Amazon. Because the bottom line is, not all of these companies have immediate projects that will drive great returns.

And in this case, they use available for sale securities as a means of earning value while they wait for those other opportunities pop up.

With that, we are going to wrap up our discussion on available for sale marketable securities.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,