The global musical instrument market size was worth USD 14.20 billion in 2022 and it is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The market for musical instruments is expected to expand over the forecast period due to increased access to musical education. This is feasible as a result of the numerous initiatives being supported or launched by governments of various countries to promote music globally. COVID-19 negatively impacted the growth of the industry. As a result of the lockdown, all businesses except essential services were closed which disrupted the supply and distribution of musical instruments thereby affecting the instrument manufacturers. The main market for musical instruments was lost when the musical shows, festivals, and concerts were canceled. However, the market is expected to gradually return to pre-pandemic levels as people resume normal life and prefer attending live concerts and shows after a long ga

The rising popularity of live concerts and performances is propelling the industry forward. Live concerts and performances are forms of musical engagement that help people improve their moods, stay healthy, boost their emotions, and socialize. It also brings together a group of people who have similar preferences and experiences in music to make connections with artists. As a result of all of these factors, people are increasingly interested in attending live musical performances. According to Bandsintown, a live music discovery and ticketing app, the total number of tickets sold in the U.S. in January 2022 were two times those sold in 2019. This is expected to significantly impact the market growth in the coming years.

The growing number of music enthusiasts is expected to boost demand for the market. Approximately 63% of consumers are hobbyists. This category includes recreational players, aspiring professionals, students, and parents of students. Children who begin learning musical instruments at a young age are more likely to develop an interest in music in the long run. This inclination helps to drive such people to pursue a career in music. These customers are expected to boost demand for musical instruments in the coming years.

Customization of musical instruments such as pianos and electronic guitars is an important market trend. Leading market players offer customized, visually appealing, and high-quality products. Customers can customize their musical instruments in terms of size and shape, as well as design guitar necks and inlays and select between traditional and hardwood options. Thus, personalization and customization of pianos and electronic guitars are expected to drive product demand during the projected timeframe.

Professional musicians who are working in the industry for a while choose to learn different instruments in their spare time as a hobby. As a result, they have a variety of instruments for personal use. Furthermore, such customers are less price sensitive and prefer to use high-quality products that require regular maintenance. This is anticipated to contribute to market growth in the coming years.

Another market trend is the advancement of technology in musical instruments. Major players are encouraged to develop and design different types of upgraded versions of musical instruments as part of the technology initiative. For example, the introduction of built-in software in musical instruments improves sound quality and allows for improved performance. Furthermore, using technologically advanced instruments provides full and clean sound, improved volume regulation, and ease of play. This is expected to boost market growth over the forecast period.

The keyboard instrument type is expected to be the fastest-growing segment with a CAGR of 7.4% during the forecast period from 2023 to 2030. The keyboard instruments type section is segmented into the piano, accordion, keyboard, and others. Piano instruments are expected to grow at the fastest rate in the segment, with a CAGR of 7.8% during the forecast period. Keyboard instruments such as piano, accordion, keyboard, and others have witnessed tremendous popularity owing to the growing number of musical performances and concerts.

Chinese musical industry has driven the sales demand for pianos among its various musical and cultural dimensions. According to the Chinese daily newspaper, Global Times Daily, the total output value of the piano industry exceeded USD 82.62 million in 2021. In addition, the newspaper reported that there were around 3,000 out of 24,000 permanent residents who work in piano-related industries.

Also, young children are fond of piano and have adopted piano learning sessions as a part of their co-curricular activities due to which the production of pianos has gained widespread demand globally. Moreover, the emerging consumer class in China is enriching children with piano lessons from parents who never had the opportunity to learn themselves.

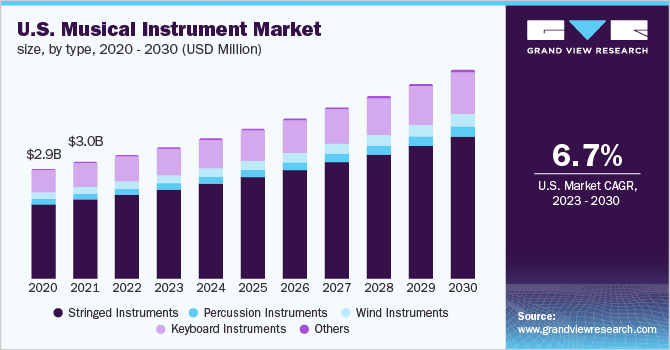

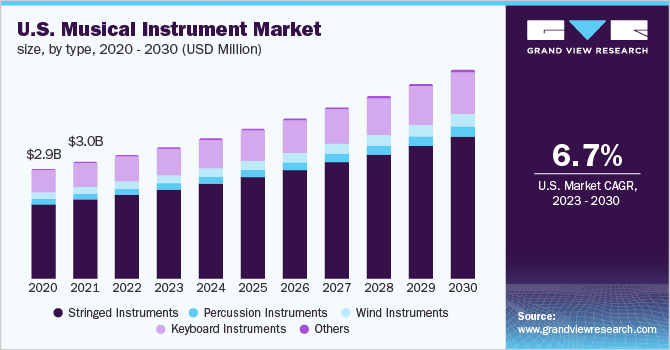

Stringed instruments type dominated the segment with the highest revenue share of 63.62% in 2022. These instruments include instruments such as guitar, violin, cello, and others. This segment's expansion can be attributed to a boost in sales of electric guitars. Guitars have grown in popularity among the millennial generation as a result of social desirability bias among people. Furthermore, as purchasing power has increased, the cost of instruments has now become comparatively cheaper over time.

The guitar segment is expected to hold the fastest growth owing to the increasing popularity of vintage instruments among consumers and major guitar manufacturers such as Fender Musical Instruments, Karl Hofner GmbH & Co. KG, Gibson Brands, Inc., consistent focus on launching innovative variants such as electro-acoustic, touch, resonator, twelve-string, and others. In addition, the growing popularity of acoustic and electric guitars has driven the purchase volume of guitars. According to the Music Trades Association, global guitar sales reached $17.2 billion in 2020, an increase of 9.5% from 2019.

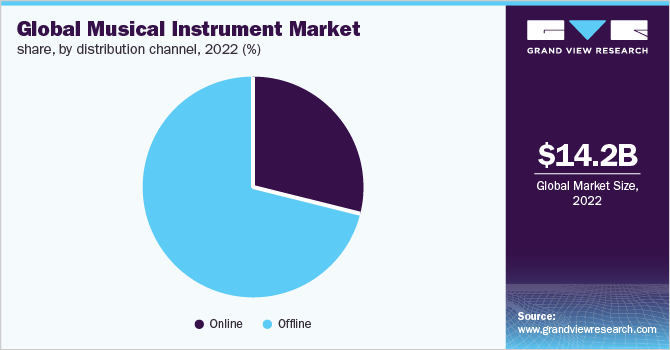

The ease of access and rising consumer preference for purchasing instruments through online channels are likely to boost online sales of musical instruments. Guitar sales are expected to continue growing in the coming years, driven by the increasing popularity of vintage instruments and the rise of online marketplaces like Reverb.com, and KADENCE.IN, among others.

Also, the key manufacturer's continual emphasis on placing innovations on its guitar variants through company-owned websites will create new opportunities for the online channel. For instance, according to a post by Music Strive, in 2021, despite the closure of factories during the onset of the pandemic 2020, Fender finished the year with a high of USD 700 million, nearly 17% more than what was achieved in 2019. The trend of online instrument purchasing will continue during the forecast period.

The offline distribution channels segment will lead the overall segmental share during the forecasted period, attributed to the musical instruments manufacturers’ strategic focus on its retail expansion to captivate customers’ purchase behavior. This aspect will likely fuel the sales of musical instruments from major retailers worldwide. According to a blog published by Guitar.com, the iconic Guitar Center store on Sunset Boulevard in Hollywood, California saw a triple-digit increase in sales in August 2020 (compared to August 2019), which the company attributed to an increase in amateur musicians and podcasters increasing interests in purchasing musical gears according to their preferences.

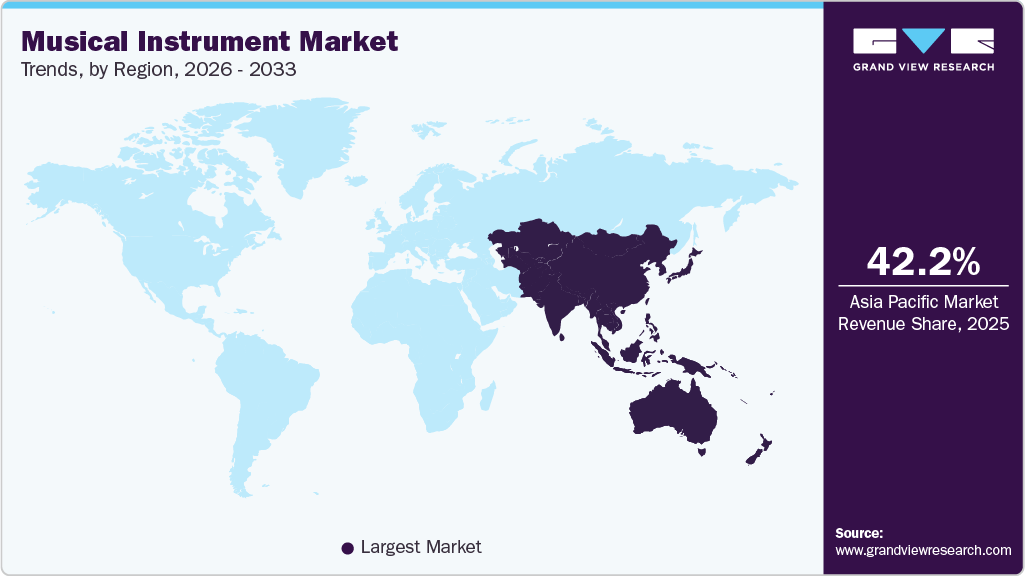

Asia Pacific held the largest revenue share of over 41% in 2022 and is expected to be the fastest-growing region with a CAGR of over 7%. The music industry as a whole is anticipated to undergo significant change in the region in terms of brand awareness and high-quality musical instruments due to the growing influence of western music in developing countries such as India and China.

Additionally, regional producers of musical instruments are concentrating on offering more regionally specific, traditional musical instruments. This is anticipated to aid in the market's expansion in the coming years. Furthermore, the region is predicted to maintain its lead over the forecast period as a large number of manufacturers establish manufacturing facilities in developing economies such as China and India. Labor and raw materials including metals, wood, and land are relatively inexpensive and readily available. Therefore, producers are employing such expansion strategies to raise brand and product awareness. This is expected to drive overall market growth.

North America is anticipated to have a significant share during the forecasted timeline of 2023-2030. This growth is due to the high demand for premium digital musical instruments, major global players are concentrating on enhancing product penetration in the U.S. Most young people choose to spend more money on these instruments because they are simple to use and learn, making them popular in the region. A large number of music events and live performances also happen in the U.S. as a result of the young population's high demand for such events. This has fueled the market's growth by accelerating the growth of the music industry as a whole.

Central & South America are predicted to grow steadily over the forecast period. The limited presence of big manufacturers is a major reason for the lack of revenue in these regions. However, due to the growing influence of western music culture, these regions are projected to see improved product and brand penetration, which will fuel the market growth during the forecast period.

The market is highly competitive and fragmented with a large number of players in the market. Major players are investing in research & development to develop innovative technologies to make instruments that are easy to use and of better quality in terms of sound quality. Furthermore, companies are also implementing strategies such as mergers & acquisitions, joint ventures, training workshops for schools or organizations, and expansions to increase sales.

For instance, in March 2022, Yamaha, a leading brand in the musical instruments market launched a new portable keyboard named PSR-E473. The new keyboard has a 61-key touch keyboard with a pro-quality music output which is suitable for both beginners and professionals. Some prominent players in the global musical instrument market include:

Report Attribute

Details

Market size value in 2023